PERFORMANCE OF PRINCIPAL MARKETS

In September, markets experienced contrasting trends, influenced by several major events. Indeed, the Chinese market rebounded sharply after the government unveiled an economic stimulus plan to support growth, while in Japan, the appointment of Shigeru Ishiba as Prime Minister raised serious concerns among investors, leading to a drop in the Nikkei. In parallel, in the United States, the Federal Reserve (FED) initiated its interest rate reduction cycle with a 50 basis point cut in its key rates, justified by the continued decline in inflation and the sluggish development of the labor market. The European Central Bank (ECB) and the Swiss National Bank (SNB), for their part, lowered their key rates by 25 basis points.

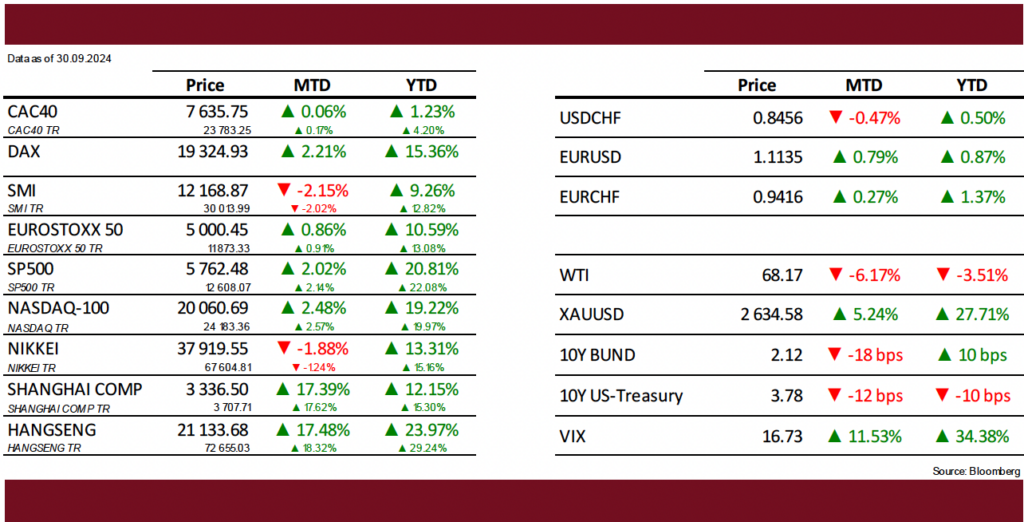

Over the past month, the S&P 500 posted a gain of +2.0%, the EuroStoxx50 +0.9%, and the CAC40 +0.1%, while the SMI closed down by -2.2% and the Nikkei by -1.9%. The Chinese market soared, with the Hang Seng index up +17.5%. On the commodities side, gold continued its upward trend, rising by +5.2%, silver by +8.0%, and copper by +6.0%, while the price of a barrel of oil (WTI) fell below the $70 mark.

ECONOMIC AND FINANCIAL ENVIRONMENT

Amid a historically dynamic economic situation, China has implemented an ambitious plan to stimulate its economy and financial markets. During a recent Politburo meeting, leaders announced an increase in budgetary spending aimed at supporting growth and reaffirmed their commitment to stabilizing the real estate market. Following this, the People's Bank of China enacted a larger-than-expected interest rate cut, lowered banks' reserve requirements, and introduced measures to reduce mortgage costs, sending a positive signal to investors. These measures triggered a powerful stock market rally, with shares seeing their best days since September 2008: the CSI300 surged +21.9%, and the Hang Seng rose +17.5%, driven by strong rebounds from large-cap stocks such as JD.com (+56% for the month), Alibaba (+35%), and Tencent (+16%).

In the United States, inflation indicators for August continued to ease. The Consumer Price Index (CPI) showed a modest increase of +0.2% for the month and +2.5% year-over-year, compared to +2.9% the previous month. Core inflation, which excludes the volatile prices of food and energy, rose by +0.3% in August and +3.2% year-over-year, slightly higher than the expected +0.2%. The PCE index, which tracks the prices of consumed goods, increased by +2.2% year-over-year, down from +2.5% the previous month, edging closer to the Federal Reserve’s target. In Europe, price increases also moderated, with the eurozone inflation rate standing at +2.2% this month, down from +2.6% in July.

Employment data for August in the U.S. was disappointing, with +142’000 non-farm payroll (NFP) jobs created versus +161’000 expected, while figures for the previous two months were revised downward by a total of -61’000 jobs. This revision is part of a much larger one announced in August by the Labor Department, which downgraded job creation between March 2023 and March 2024 by -818’000 jobs — nearly 30% of the jobs initially reported during that period, marking the largest revision since 2009! For August, the majority of the new jobs created were in construction (+34’000), healthcare (+31’000), and social assistance (+13’000). Despite these relatively weak job gains, the unemployment rate only slightly decreased to 4.2%, from 4.3% in July. However, the real unemployment rate, which excludes discouraged workers who have stopped looking for work and adjusts for part-time jobs, stands at 7.9%, its highest level since October 2021

Although the U.S. economic outlook appears to be moving in the right direction according to the figures released by the administration, and investors remain optimistic following the recent action by the Federal Reserve (FED), certain historical indicators still call for caution. These include the rise in the real unemployment rate in recent months, the steepening of the yield curve that had been inverted since mid-2022, and the continued decline in the Leading Economic Indicator (LEI) for the sixth consecutive month.

In this environment, the "soft landing" scenario, which has been the consensus for months, remains the preferred outcome. The prospect of interest rate cuts seems sufficient for investors, who are convinced that monetary policy changes alone can prevent a deterioration in the economic situation and allow financial markets to continue their strong momentum, despite current valuations—especially those of certain large-cap stocks—being historically high. In the short term, perhaps, but we remain skeptical over the medium term, as these valuations already factor in significant monetary easing (-200 basis points by the end of 2025), while earnings growth struggles to justify the continued market rally. In any case, the FED will need to continue navigating very skillfully to avoid a scenario of economic slowdown or even a recession.

OUR THOUGHTS AND ACTIONS

In the current environment, still characterized by significant fiscal support and an accommodative US Federal Reserve, we maintain a neutral asset allocation, both in terms of exposure to risky assets and geographical distribution. At the same time, with the cycle of interest rate hikes nearing its end and geopolitical tensions remaining high, we are increasing our exposure to medium- and long-term quality bonds at the expense of short-term bonds, while continuing to hold our investments in gold.